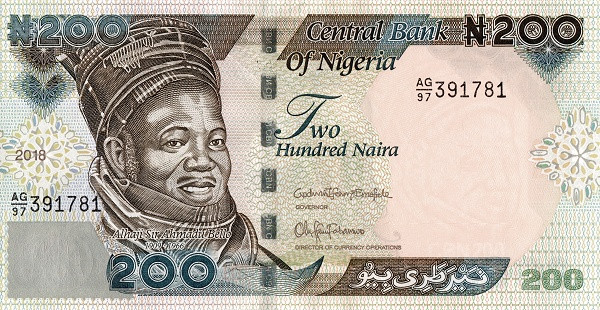

[BREAKING] #Buhari approves continued use of old N200 notes for 60 Days

Buhari has approved the continued use of the old N200 notes.

The old N200 notes will coexist with the new N200 notes, the Nigerian leader said.

He, however, did not allow the continued use of the old N500 and N1,000 notes, only saying the CBN would continue to accept them.

Mr Buhari stated this in a national broadcast Thursday morning.

It is not clear if the new directive will reduce the naira scarcity being experienced by Nigerians.

However, the old N200 notes will remain valid for the next 60 days, Mr Buhari said.

“To further ease the supply pressures, particularly to our citizens, I have given approval to the CBN that the old N200 bank notes be released back into circulation and that it should also be allowed to circulate as legal tender with the new N200, N500, and N1000 banknotes for 60 days from February 10, 2023, to April 10, 2023, when the old N200 notes cease to be legal tender,” the president said.

Naira scarcity

On 26 October 2022, the Central Bank of Nigeria announced the introduction of redesigned 200, 500 and 1,000 naira notes into the country’s financial system. But since the notes were unveiled, Nigerians across different parts of the country have been struggling to access them from banks and ATM cash points.

As the frustration caused by the scarcity of the new notes worsened trade and business transactions, the CBN extended the deadline for the phasing out of the old notes from 31 January deadline to 10 February. Yet, many Nigerians working in both the formal and informal sectors of the economy have been scrambling for the new currency.

Last week, the Supreme Court gave a restraining order barring the implementation of the 10 February deadline set by the CBN to phase out the old notes.

But in what appears a disregard for the rule of law, both President Muhammadu Buhari and the CBN governor, Godwin Emefiele who initiated the policy, refused to adhere to the court order.

Addressing constraints

On Thursday, the president emphasised that he is not unaware of the obstacles placed on the path of innocent Nigerians by unscrupulous officials in the banking industry entrusted with the process of implementation of the new monetary policy.

“ I am deeply pained and sincerely sympathise with you all, over these unintended outcomes,” he said.

To address the concerns, Mr Buhari said he has directed the CBN to deploy all legitimate resources and legal means to ensure that citizens are adequately educated on the policy, enjoy easy access to cash withdrawal through the availability of appropriate amounts of currency, and facilitate deposits.

Similarly, the president said he has directed that the CBN should intensify collaboration with anti-corruption agencies, to ensure that any institution or person found to have sabotaged the implementation of the policy is duly prosecuted according to extant laws.

“During the extended phase of the deadline for currency swap, I listened to invaluable pieces of advice from well-meaning citizens and institutions across the nation,” the president stated.

He said he had similarly consulted widely with representatives of the State Governors as well as the Council of State.

“Above all, as an administration that respects the rule of law, I have also noted that the subject matter is before the courts of our land and some pronouncements have been made,” he said.

Mr Buhari reiterated that in line with Section 20(3) of the CBN Act 2007, all existing old N1000 and N500 notes remain redeemable at the CBN and designated points.

”Considering the health of our economy and the legacy we must bequeath to the next administration and future generations of Nigerians, I admonish every citizen to strive harder to make their deposits by taking advantage of the platforms and windows being provided by the CBN,” he said.

“Let me assure Nigerians that our administration will continue to assess the implementation with a view to ensuring that Nigerians are not unnecessarily burdened. In this regard, the CBN shall ensure that new notes become more available and accessible to our citizens through the banks.